Student Loan support to help you get your degree.

Navigating student loans can be confusing. We simplify the process so you can focus on your education, not the paperwork.

Trusted by these top universities

All the tools you need to take control of your student loans.

Simplify your student loan management with tools designed to help you understand, organize, and optimize your repayment journey.

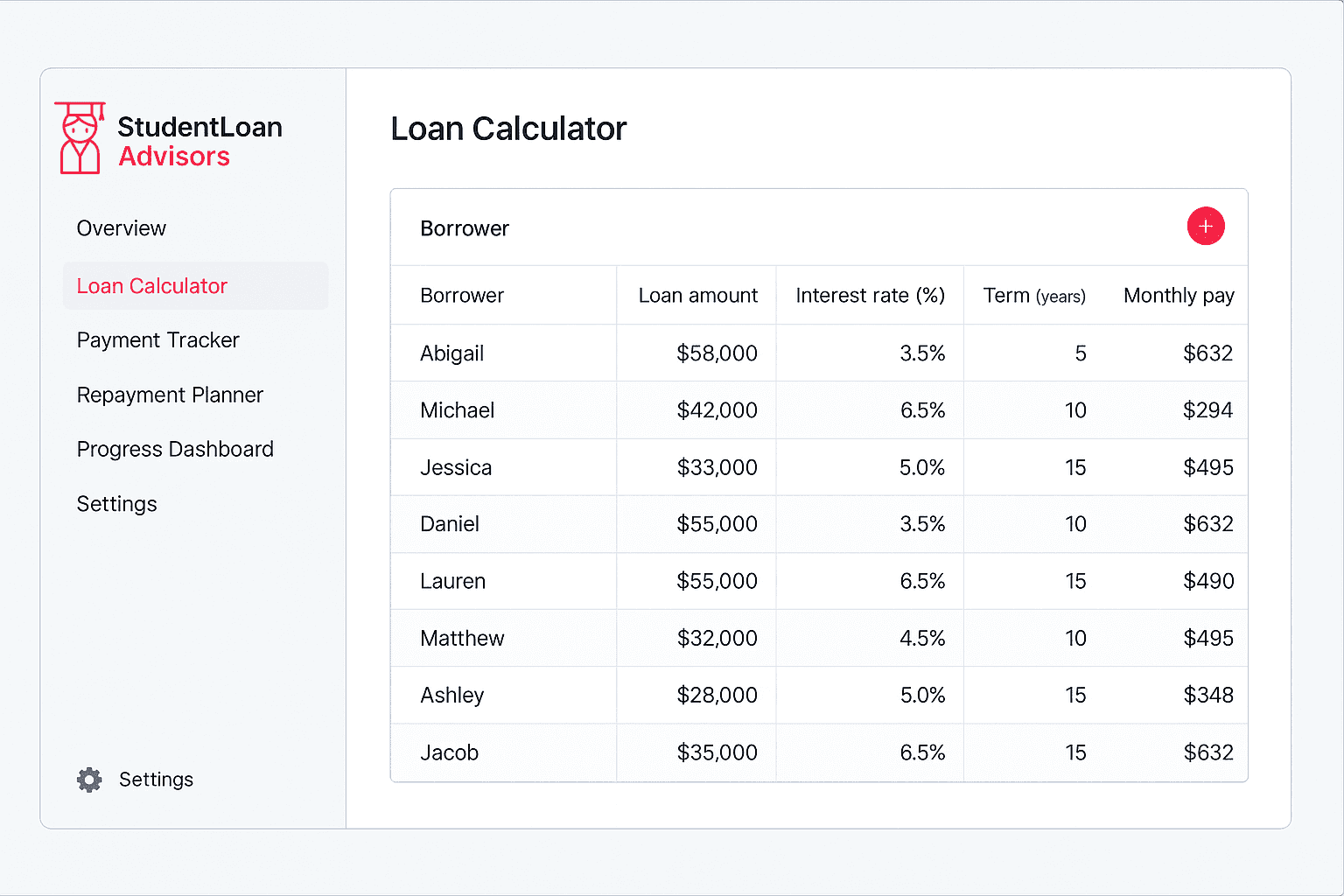

Calculate your estimated monthly payments and total interest based on your loan amount, interest rate, and repayment term. Perfect for comparing different loan options.

Yes, everything is completely free.

No catches, no hidden fees, no “premium” features. We’re here to help, not to profit from your education.

Loan Planning

Because financial planning shouldn't cost you more money.

- Loan calculator and comparison tools

- Personalized repayment strategies

- Interest rate optimization tips

- Budget planning assistance

- Complete loan tracking dashboard

- Debt-to-income ratio analysis

FAFSA & Aid

Yes, it's still free. We really mean everything.

- Step-by-step FAFSA guidance

- Federal aid eligibility check

- Scholarship database access

- Grant application assistance

- Aid package comparison tools

- Appeal letter templates

- Deadline reminders and alerts

Career Support

Wait! Did we mention it's all free? Because it is.

- Career path exploration tools

- Salary vs. loan burden analysis

- Interview preparation resources

- Resume and cover letter review

- Networking opportunity alerts

- Job search assistance

Tools for smarter education planning.

Make informed decisions about your education and future career with our comprehensive planning resources.

Scholarship Finder

Discover scholarship opportunities that match your profile and interests.

Access our regularly updated database of scholarships and grants. Filter by your major, GPA, location, and other criteria to find opportunities you're most likely to qualify for.

FAFSA Guide

Step-by-step assistance for completing your FAFSA application accurately.

Our interactive guide helps you understand each section of the FAFSA, explains required documentation, and provides tips to help maximize your federal aid eligibility.

Career Planning

Explore potential career paths and their impact on loan repayment.

Research different career paths and their average starting salaries. Compare this with your potential loan burden to make informed decisions about your education and career choices.

Discover scholarship opportunities that match your profile and interests.

Access our regularly updated database of scholarships and grants. Filter by your major, GPA, location, and other criteria to find opportunities you're most likely to qualify for.

Step-by-step assistance for completing your FAFSA application accurately.

Our interactive guide helps you understand each section of the FAFSA, explains required documentation, and provides tips to help maximize your federal aid eligibility.

Explore potential career paths and their impact on loan repayment.

Research different career paths and their average starting salaries. Compare this with your potential loan burden to make informed decisions about your education and career choices.

Take charge of your student loans today

Get expert guidance and personalized strategies to manage and reduce your student loan debt. Start your journey to financial freedom with Student Loan Advisors.

Sign up

Frequently asked questions

If you can’t find what you’re looking for, email our support team and if you’re lucky someone will get back to you.

How do I know if I qualify for federal student loans?

To qualify for federal student loans, you need to be a U.S. citizen or eligible noncitizen, have a valid Social Security number, be enrolled in an eligible degree program, and maintain satisfactory academic progress. The first step is completing the FAFSA (Free Application for Federal Student Aid).

What's the difference between subsidized and unsubsidized loans?

Subsidized loans are need-based loans where the government pays the interest while you're in school. Unsubsidized loans accrue interest from the date of disbursement and are available regardless of financial need.

When should I start applying for scholarships?

Start applying for scholarships as early as your junior year of high school and continue throughout college. Many scholarships have deadlines 6-12 months before the academic year starts, so early preparation is key.

How can I increase my chances of getting scholarships?

Maintain good grades, participate in extracurricular activities, gather strong recommendation letters, and apply to many scholarships - even smaller ones. Also, pay attention to application requirements and deadlines, and write compelling personal statements.

Should I consider private student loans?

Private student loans should typically be considered only after exhausting federal loan options, grants, and scholarships. They often have higher interest rates and less flexible repayment options than federal loans.

What are income-driven repayment plans?

Income-driven repayment plans adjust your monthly federal student loan payments based on your income and family size. They can make payments more manageable and may lead to loan forgiveness after 20-25 years of qualifying payments.

How does student loan interest work?

Interest on student loans typically accrues daily. For unsubsidized loans, interest accumulates while you're in school. After graduation, any unpaid interest may be capitalized (added to your principal balance), increasing the total amount you owe.

What is loan forgiveness and how can I qualify?

Several loan forgiveness programs exist, including Public Service Loan Forgiveness (PSLF) for government and nonprofit workers, and Teacher Loan Forgiveness. Each program has specific requirements for employment, payment history, and loan types.

How can I avoid taking on too much student debt?

Consider attending a more affordable school, maximize scholarship and grant opportunities, work part-time during school, borrow only what you need for educational expenses, and understand the long-term implications of your loan choices.

Hear from students and graduates we’ve helped.

Discover how our tailored advice and support have enabled people to better manage their student loans. Read real stories from those who have worked with Student Loan Advisors.

Student Loan Advisors helped me understand my financial aid options and find scholarships I didn't even know existed. Thanks to them, I'm graduating with significantly less debt than I expected.

Sarah BennettSenior at Northwestern UniversityWhen I was overwhelmed with different loan options, their team broke everything down in a way that made sense. They helped me choose the best repayment plan for my situation.

Amanda HarrisJunior at Yale University

Thanks to their guidance, I was able to secure both federal and private loans with better terms than I originally found. They even helped me understand loan consolidation options for after graduation.

Luke KennedyGraduate Student at Duke UniversityThe scholarship matching service was incredible! They helped me find and apply for scholarships that perfectly matched my profile. I received three awards that will cover half my tuition.

Emma PattersonFreshman at UCLA

Their FAFSA assistance was invaluable. They caught mistakes I would have made and helped maximize my aid package. I'm now attending my dream school without crushing debt.

Paul RichardsSophomore at CalTechThe financial planning workshops changed how I view student debt. They helped me create a realistic budget and showed me how to minimize loans while still getting quality education.

Ashley HendersonSenior at Georgia Tech